If high taxes guaranteed results, then California should have some of the best roads in the nation. For years we’ve had one of the highest gas taxes, yet our freeways consistently receive failing grades.

It makes no sense unless you admit that high taxes don’t guarantee good roads. That’s one of many reasons I had no trouble voting with my State Board of Equalization colleagues to approve a 6 cent cut to the state’s gas tax. Under a confusing and complicated law commonly known as the “gas tax swap,” the state has been over collecting tax dollars as gas prices have fallen. The new rate helps solve this problem.

Any tax cut is a rare bit of good news for overtaxed Californians. This gas tax cut also has the added benefit of partially offsetting the cost of a new hidden gas tax that took effect January 1 to help fund high speed rail and other so-called anti-global warming efforts.

California will still have one of the highest gas tax rates in the nation, but even so not everyone is pleased to see the tax go down. In fact, some government officials are devising new schemes—like mileage taxes and road user fees—aimed at getting even more of your dollars.

But before you send any more money to Sacramento, you deserve a clear picture of just how much money the state already receives for transportation and how those dollars are spent.

Here are a few key facts the media often fails to report:

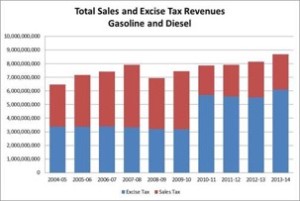

- Fuel tax revenues have grown – Even as vehicles have become more efficient, fuel tax revenues grew 35% in the past ten fiscal years—from $6.5 billion to a record $8.7 billion. Most of these dollars are reserved for transportation, although some sales tax dollars go directly to local governments.

- Total transportation spending is an estimated $28 billion – Fuel taxes are only one piece of the transportation funding puzzle. The Legislative Analyst’s Office estimates total transportation funding in California from all sources of government is $28 billion. About half of this funding comes from local governments, and a quarter each from the state and federal government.

- There’s plenty of money available – Governor Brown’s proposed $113 billion General Fund budget would be a record high for state spending. Even so, it provides very little funding for transportation. Perhaps because most transportation funding now comes from special funds, California’s spending on highways is below average when compared to other states. At the same time, California’s overall state spending and welfare spending both exceed the national average. If we need more funding for roads, why not use General Fund dollars like we did in the past? It’s all about priorities.

California taxpayers are not getting good value for the dollars they send to Sacramento. Due to questionable laws and regulations, the cost of transportation and infrastructure projects is far higher in California than other states. It’s a tough sell to say Sacramento needs more money when projects like high speed rail and the Bay Bridge are plagued by waste and cost-overruns.

The State of California ought to be investing your tax dollars wisely and cost-effectively, not wasting them on bullet trains and bureaucracy. If our leaders spent less time concocting new tax schemes and more time properly stewarding existing funds, perhaps we’d all spend less time stuck in traffic. Maybe someday we could have the best roads again, too.