The coalition seeking to put a statewide bond measure for school construction on the ballot in California in 2016 appears to have succeeded. It submitted petitions with signatures to the California Secretary of State several weeks ahead of the deadline.

The Secretary of State will soon determine if the coalition obtained enough valid signatures to qualify the bond measure for the ballot. Based on current projections, California voters will indeed get the chance in 2016 to authorize the State of California to borrow $9 billion via bond sales to help local school districts build or renovate facilities.

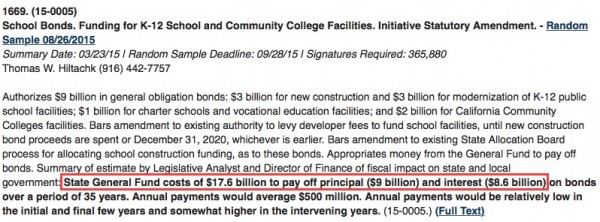

Three ballot measures authorizing the state to borrow a total of $35.8 billion for school construction passed easily in the mid-2000s. It’s likely California voters will soon agree to add another $17.6 billion to the state’s debt obligation.

Why will the bond measure cost $17.6 billion if the ballot says $9 billion?

Money borrowed from bond investors has to be paid back with interest. Most voters don’t realize that the financial industry and wealthy investors make money from bond measures for school and college district construction. “Issuance fees” are paid to parties involved in the preparation and sale of the bonds. Money made from buying municipal bonds is tax-exempt, so they are a valuable investment strategy for investors with significant assets.

Lack of public understanding about bonds and the resulting lack of public accountability have allowed abuses to develop in the 15 years since 53% of California voters passed Proposition 39 in 2000. Proposition 39 changed language in the California Constitution that voters added through Proposition 13 in 1978. It reduced the voter approval threshold for school bond measures from two-thirds to 55% and unleased a flood of bond debt.

On August 27, the McKinleyville Union School District near Eureka (in Humboldt County) held a grand opening for a new gymnasium funded by a bond measure approved by district voters in 2008. As reported in the Eureka Times-Standard newspaper, school officials point out that the entire community can be proud of the new modern gym and enjoy it. The gym is described as the “capstone” of a construction program funded by $14 million borrowed from bond investors.

Readers of this newspaper article are not informed that this construction program does not actually cost $14 million. Right now taxpayers in the McKinleyville Union School District will have to pay $61 million by 2047 for projects such as this gym.

Put this $61 million in perspective. The student enrollment in the district is 1180, the population of the school district is a little more than 15,000, and the assessed value of all secured property in the district is $1.3 billion. The top taxpayer in the district (by a wide margin) is an assisted living facility.

How did this happen? The McKinleyville Union School District sold long-term Capital Appreciation Bonds, which are sold at a deep discount from the face value and accumulate compound interest during the maturity period. When the bonds mature decades after they are sold, the investor gets the return as one big chunk of money.

It’s a good thing that the district sold Capital Appreciation Bonds that could be refinanced – considering that in 2014 the district reported debt service of $115 million as a result of borrowing the $14 million. School districts such as the Poway Unified School District sold non-callable Capital Appreciation Bonds and are stuck with stunning debt ratios.

Of course, numerous parties involved in the transaction earn fees every time bonds are refinanced. And taxpayers pay those fees.

On the same day that this new gym opened, the North Coast Journal, a Humboldt County alternative weekly newspaper, published a lengthy article noting that the gym was built under an alternative project delivery method called “lease-leaseback.” It noted that a major donor to the campaign to pass the bond measure in 2008 was selected to build the gym through a non-traditional bidding process using subjective criteria. Such lease-leaseback contracts were declared illegal by a California appeals court earlier this year, but the California Supreme Court is likely to consider an appeal of the decision by the school district that lost the case.

Californians need to better understand bonds and the debt accumulated through bond measures. In the meantime, expect the borrowing to continue. As an expert on school construction recently told the Marin Independent-Journal about a $269 million proposed bond measure in San Rafael, “It’s a lot of money, but it’s not unreasonable…That’s what it costs if you want to give your children what they deserve.”

Sources

Official Statement for McKinleyville Union School District 2015 General Obligation Refunding Bonds – Municipal Securities Rulemaking Board (MSRB) Electronic Municipal Market Access (EMMA)

Official Statement for McKinleyville Union School District 2014 General Obligation Refunding Bonds – Municipal Securities Rulemaking Board (MSRB) Electronic Municipal Market Access (EMMA)

McKinleyville Middle School Hosts Gym Grand Opening – Eureka Times-Standard – August 27, 2015

The $50 Million Henhouse: With bond money to spend, Eureka City Schools is using controversial and legally questionable contracts. Who’s watching? – The North Coast Journal – August 27, 2015

San Rafael School Bonds Would Pay for Repairs, Construction – Marin Independent-Journal – August 22, 2015

Initiatives and Referenda Pending Signature Verification – California Secretary of State – August 27, 2015

For the Kids: California Voters Must Become Wary of Borrowing Billions More from Wealthy Investors for Educational Construction – California Policy Center – July 2015

Kevin Dayton is the President & CEO of Labor Issues Solutions, LLC, and is the author of frequent postings about generally unreported California state and local policy issues at www.laborissuessolutions.com. Follow him on Twitter at @DaytonPubPolicy.