Every Four Years, A Golden Opportunity for Revenue Enhancement

November 8, 2016 will likely be a triumphant day for Californians who believe individuals, households, and businesses aren’t giving enough of their money to the government.

The recent deliberation and turmoil in the California legislature about tax increases will be handed off to voters, who will make quick decisions based primarily on deceptive ballot titles. Meanwhile, as many as 150 local K-12 school and community college districts will ask voters for authorization to borrow money for construction via bond sales. In addition, voters will get to consider local parcel taxes, utility taxes, transportation taxes, San Francisco Bay Restoration taxes – all sorts of taxes.

Why is this election going to be so special? Political consultants assume that Californians inspired to vote because of the historic candidacy of Hillary Clinton for President will extend their excitement to the approval of taxes, borrowing, and spending farther down the ballot.

This assumption is based on performance of bond measures and proposed tax increases in the past two presidential general elections. If the 2008 presidential general election resulted in 53% approval for the state to borrow $9.95 billion for high-speed rail, surely the 2016 presidential general election will bring more miracles of modern democracy.

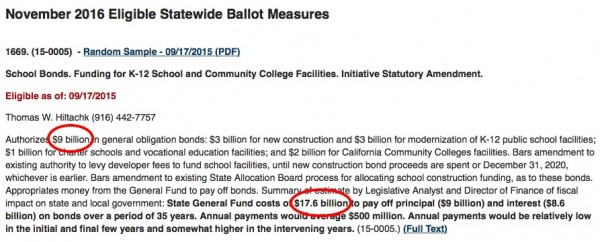

Believe it or not, one statewide bond measure is already eligible for the November 2016 ballot.

Give the Children Another $17.6 Billion in Debt

Unless a deal is made at the Capitol to obtain the money some other way, you’ll be voting in November 2016 on a proposal for the State of California to borrow $9 billion via bond sales for educational facility construction. Last week, the California Secretary of State confirmed that a coalition of construction companies and organizations had collected enough petition signatures to put this bond measure on the ballot.

This $9 billion is meant to ensure that “K-14 facilities are constructed and maintained in safe, secure and peaceful conditions.” A more obscure amount is the additional $8.6 billion that the state will pay to bond investors as interest on the borrowed money.

Here’s the fiscal analysis from the California Legislative Analyst’s Office: “The state would likely issue these bonds over a period of about five years and make principal and interest payments from the state’s General Fund over a period of about 35 years. If the bonds were sold at an average interest rate of 5 percent, the cost would be $17.6 billion to pay off both principal ($9 billion) and interest ($8.6 billion).”

That’s just the first statewide bond measure qualified for the November 2016 ballot. On the local level, expect an unprecedented number of bond measures and proposed tax increases.

Watch Your Local Government Agendas

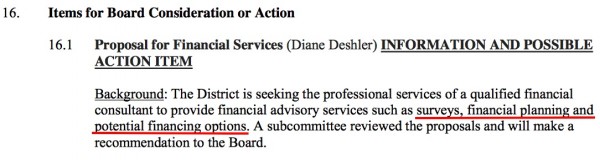

Have you looked at the recent meeting agendas for your local government boards and councils? Right now local governments throughout California are adopting vague contracts for “feasibility studies” or “surveys.” This kind of research comprises an early step in preparing a campaign for a bond measure or proposed tax increase. And yes, local governments can legally use public money to pay for it.

This agenda item is preparation at the Martinez Unified School District for a parcel tax on the ballot in 2016. Would you have guessed that?

When campaign mailers and phone banks bombard your household in October 2016 promoting wonderful things on the ballot, realize that consultants had been working for more than a year with taxpayer funding to develop an effective message aimed at voters.

The Time Is Now to Analyze and Plan for These Bond Measures and Proposed Tax Increases

As bond measures and proposed tax increases start accumulating for the November 2016 ballot, Californians need to ask some analytical questions.

For example, is it a wise decision to authorize the state to borrow another $9 billion for educational construction, considering that since 2001 voters have approved the state and local school and community college districts to borrow a total of $146 billion for facilities construction? Should $17.6 billion be added to the $200 billion in existing bond debt for school construction? Do the increasing number of abuses and scandals involving school and community college district construction programs indicate an urgent need to revamp old laws concerning bond finance and construction contracts?

On the local level, it’s obvious that in recent years many proposed bond measures for school districts have not been considered in the context of past and projected enrollment declines. Nor has any attention been paid to the debt that still needs to be paid off from previous bond measures. Should these conditions matter?

Some state and local bond measures and tax increases proposed for the November 2016 election may be reasonable and justified. But the time to evaluate these proposals, make a judgement in the public interest, and prepare for the November 2016 election needs to begin now. September 2016 will be too late to make a difference.

Kevin Dayton is the President & CEO of Labor Issues Solutions, LLC, and is the author of frequent postings about generally unreported California state and local policy issues at www.laborissuessolutions.com. Follow him on Twitter at @DaytonPubPolicy.