The Tax Man Cometh: I am sure most of you loyal readers of this missive do not need a reminder, but yesterday was April 15, and you know what that means…Tax Day. If you think your taxes are bad now…you need to take a look at the lists below.

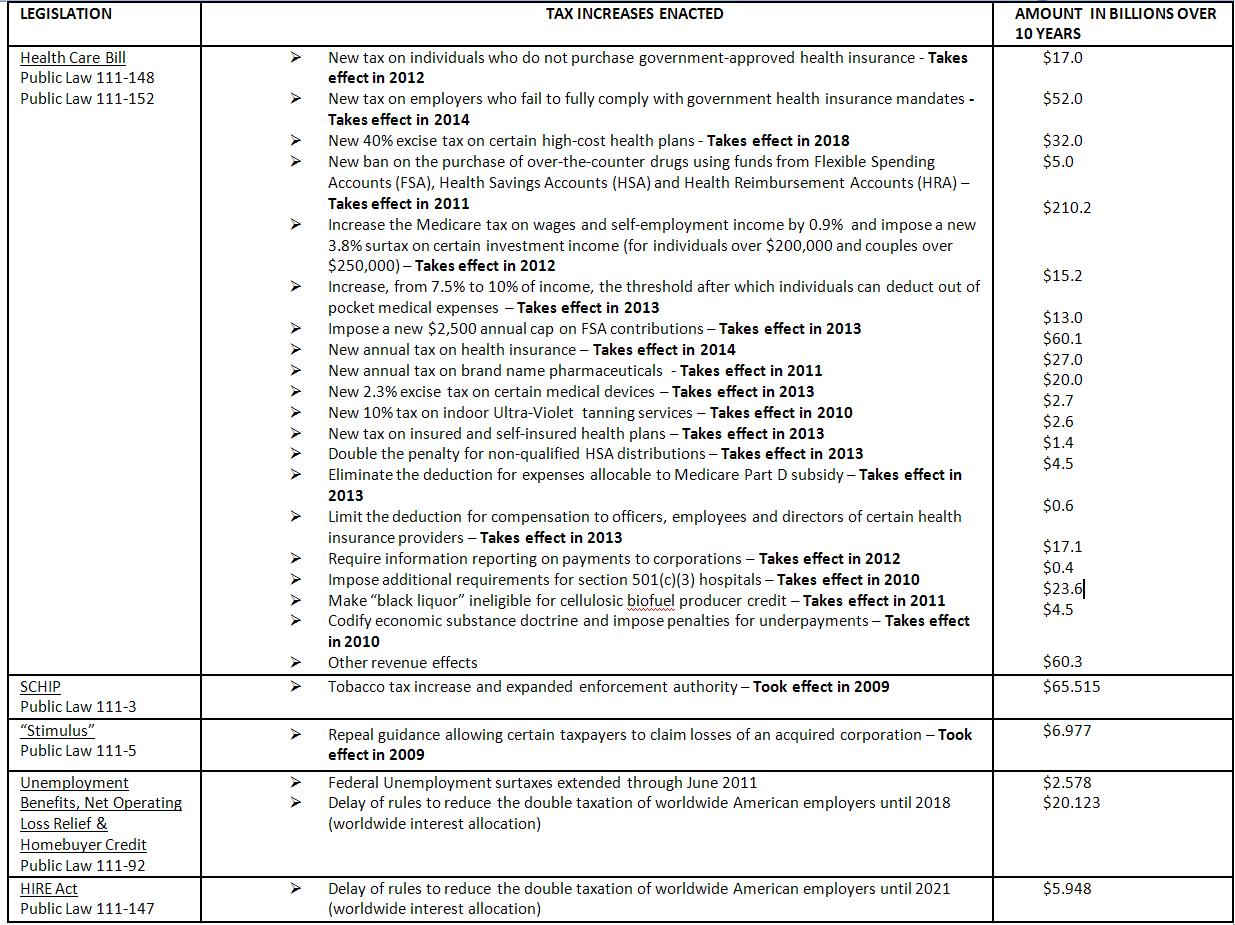

Tax Increases Enacted since January 2009

This list, totaling more than $670 billion in tax increases includes the Health Care Bill, SCHIP, the Stimulus Package, and several other pieces of legislation which have been signed into law by President Obama.

Pending Tax Increases if Congress Takes no Action

2010:

- The exemption for the Alternative Minimum Tax (AMT) will decrease from $46,700 to $33,750 for single filers and from $70,950 to $45,000 for married couples filing jointly.

- Taxpayers will not be allowed to deduct their state and local general sales taxes from

their federal income tax. - Businesses will not be able to claim a tax credit for research, experimentation, and

development activities. - Taxpayers will not be able to claim a deduction for qualified tuition and related expenses.

- School teachers will no longer be able to write off books, supplies and other equipment

that they purchase with their own money for the classroom. - Five year depreciation of farm business machinery and equipment will expire.

- Business property on Indian reservations will no longer be depreciated at an accelerated

rate. - Donations of books to public schools (K-12) will no longer be eligible for an enhanced

charitable deduction. - Corporate contributions of computer equipment for educational purposes will no longer

be eligible for an enhanced charitable deduction. - The minimum required distribution rules for IRAs and defined contribution plans will no

longer be waived. - Tax-free distributions from individual retirement plans for charitable purposes will no

longer be allowed. - The tax credit for first-time DC homebuyers will expire.

- Tax incentives for investment in DC, including the DC Zone employment tax credit, will

expire. - "Renewal Community" tax incentives will expire.

- The net operating loss (NOL) carryback period for small businesses will decrease from 5

years to 2 years. - The first-time homebuyer credit will expire at the end of April 2010.

2011:

- The marginal income tax rates will increase as follows:

- 35% bracket will increase to 39.6%

- 33% bracket will increase to 36%

- 28% bracket will increase to 31%

- 25% bracket will increase to 28%

- 10% and 15% brackets will condense to 15%

- Dividends will no longer be taxed at the capital gains rate for individuals, thereby

increasing the double taxation of dividends by as much as 164%. - The personal capital gains tax will increase to 20% and 10% (from 15% and 5%).

- The child tax credit will decrease from $1,000 to $500.

- The standard deduction for couples as a percentage of the standard deduction for singles

will decrease from 200% to 167%–restoring the marriage penalty. - The top end of the 15% marginal income tax bracket for couples as a percentage of the top

end for singles will decrease from 200% to 167%–restoring the marriage penalty. - The "death" tax using the "stepped up" basis will return with a 55% maximum rate

(including surtax) and a $1 million exemption, after years of decreasing "death" tax rates,

increasing exemptions, one year using the "carryover" basis to calculate the tax due, and one

year of total elimination (2010). - The Section 179 business expensing cap will decrease from $250,000 to $125,000 (plus

inflation after 2008), and the starting point for the phase-out of this deduction will decrease

from $800,000 to $500,000. - The dependent care tax credit will decrease from $3,000 to $2,400.

- The American Opportunity Tax Credit will expire.

- No longer will individuals be able to receive a credit to purchase energy efficient home

appliances. - The tax credit to hire unemployed veterans and disconnected youth will expire.

- The Work Opportunity Tax Credit, which allows employers to credit up to 40% of the

first-year wages of a new employee, will expire. - The $400 "Making Work Pay" Tax Credit will expire.

2012:

- The adoption tax credit will decrease from $13,170 to $5,000.

- The credit for electric drive motorcycles, three-wheeled vehicles, and low-speed vehicles

will expire. - The conversion credit for plug-in electric vehicles will expire.

2013:

- The tax credit for cellulosic biofuel producers will expire.

- The tax credit for the production of Indian coal will expire.

- The election to claim the energy credit in lieu of the electricity production credit for wind

facilities will expire. - The special depreciation allowance for cellulosic biofuel plant property will expire.