This just in from our friends at the Foundation for Educational Choice, who will be holding a press conference today on this subject at 11:30 near the State Capitol (send an email here to get details)…

California’s public retirement systems are more than three times underfunded than state officials projected, a total of $326.6 billion when combining the state’s teachers’ and public employee programs, according to a new study released today by the Foundation for Educational Choice.

[You can see a .pdf of the study by clicking on the link at the bottom of this post.]

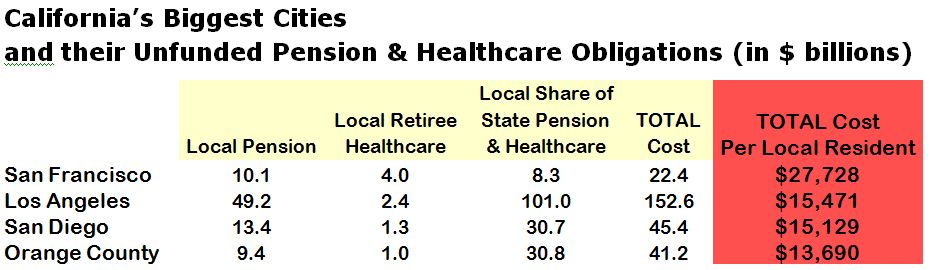

Meanwhile, in Los Angeles, San Francisco, San Diego and Orange County, local pension systems for city and county public employees are also underfunded as much as $49.2 billion, according to “Trouble Brewing, The Disaster of California State Pensions.”

While the unfunded pension liability is $326.6 billion for state pension programs, the pension shortfall is $49.2 billion in Los Angeles, $10.1 billion in San Francisco, $13.4 billion in San Diego and $9.4 billion in Orange County. Those figures do not include promised healthcare benefits to public-sector retirees.

“These numbers are mind-boggling,” said Robert Enlow, President and CEO of the Foundation for Educational Choice. “It’s a pipe dream to think that California can provide a quality education, keep prisoners behind bars, pave roads and meet other obligations when such enormous bills are coming due.”

The state of California reports a $75.5 billion pension shortfall — $40.5 billion to the California State Teachers’ Retirement System or CalSTRS and $35 billion to the California Public Employee Retirement System or Cal PERS.

But the Foundation’s study found that if more accurate, private-sector accounting measures were used to determine outstanding pension obligations, the total pension shortfall would be an astounding $326.6 billion with an additional $51.8 billion in unfunded employee health benefits.

“That means the state must find $378.4 billion in taxpayer funds to take care of promises made to these retirees,” said Vicki E. Murray, Associate Director of Education Studies at the Pacific Research Institute. “The problem is California doesn’t have two nickels right now to pay its current bills or even keep the lights on.”

The unfunded state pension obligation alone is more than four times all general fund revenue the state of California will raise in 2010, according to the study’s author, University of Arkansas research fellow Stuart Buck.

California’s pension systems have traditionally assumed a rosy rate of return on their investments – 7.75 percent or 8 percent annually. After a decade of zero stock market growth, Buck says the new rate of return should be 5.2 percent, decreasing the value of pension portfolios.

In addition, Buck recommends that public officials move new employees into a Defined Contribution Plan to reduce the risk to taxpayers who must pay for these state and local employees’ retirement plans decades into the future.

“The definition of insanity is doing the same thing over and over,” The Foundation’s Enlow said. “California is already digging itself into a deeper and deeper hole. Without dramatic change in it the way it funds pensions for teachers and state and local public employees, it will drive taxpayers out of state and break the back of business. Something has to change.”

When you factor in local taxpayers’ obligation to help pay for state retiree benefits, plus the cost to pay for local retiree benefits, the burden per resident is $27,728 in San Francisco; $15,471 in Los Angeles; $15,129 in San Diego; and $13,690 in Orange County.

“This confirms our worst fears about just how bad this pension crisis is and how much taxpayers will be expected to pay up,” said Jon Coupal, President of the Howard Jarvis Taxpayers Association. “The bad news seems to get worse every day. Urgent reform is needed now. Californians cannot wait.”

About The Foundation for Educational Choice

The Foundation for Educational Choice is a 501(c)(3) nonprofit and nonpartisan organization, solely dedicated to advancing Milton and Rose Friedman’s vision of school choice for all children. First established as the Milton and Rose D. Friedman Foundation in 1996, the foundation continues to promote school choice as the most effective and equitable way to improve the quality of K-12 education in America. The foundation is dedicated to research, education, and promotion of the vital issues and implications related to choice and competition in K-12 education.

Download a .pdf of the study via the link below.