In July 2015 the California Policy Center published For the Kids: California Voters Must Become Wary of Borrowing Billions More from Wealthy Investors for Educational Construction. This report exhaustively details how California voters from 2001 through 2014 authorized the State of California and 642 local educational districts to borrow a total of $146 billion for facility construction, resulting in an astonishing $200 billion in debt now owed to bond investors. It also reveals the many obscure bond finance and expenditure schemes adopted by school and college districts over the past 15 years to circumvent taxpayer protections and voter intentions.

Obviously the study has been criticized by politicians and the many interests that make money from bond measures. But data-based assessment of bond measures has also been criticized by advocates for fiscal responsibility. On August 16, I received an email from a Southern California local taxpayer activist who doubted the value of exposing and highlighting irresponsible public debt that results from local school bond measures:

On a related topic, on your web site, you show what was done to try and defeat the Sacramento City USD bond in 2012. Without disrespect intended, those kind of financial and logical arguments make voters’ eyes glaze over – a result of the dumbing down of America…the arguments have to appeal to one or more of the major emotions. The vast majority…of voters don’t vote based on reason or logic. They vote based on emotion.

Regrettably, this observation seems to be accurate. Seven out of ten voters in the Sacramento City Unified School District approved that $414 million package of bond measures in November 2012. They didn’t know or didn’t care about the 22% drop in district enrollment during the previous ten years or the immediate debt burden of $522 million accumulated from two earlier bond measures. Perhaps inspired by the campaign of First Lady Michelle Obama, voters apparently responded positively to celebrity chefs such as Alice Waters highlighting how new kitchens in the district would “improve the overall health and nutritional experience of students.”

Despite such discouraging results, advocates of fiscal responsibility must be persistent with the message to the public that some educational districts need to take a break from the relentless borrowing. Californians need to be aware of how bond measures are continually accumulating debt that future generations – our children and grandchildren – will have to pay back to bond investors.

Although the presidential election year of 2016 will likely offer voters a $9 billion statewide school bond measure and 150 or more local school bond measures, 2015 isn’t slipping by without appeals to voters to borrow more money. Below are seven bond measures on the November 3, 2015 ballot as proposed by six California school districts.

School Bond Measures on November 3, 2015 Ballot: Ranked by Amount Proposed to Borrow

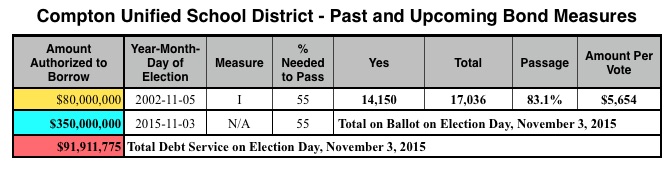

1. The Compton Unified School District in Los Angeles County has restrained its borrowing for school construction and has responsibly managed its debt. Now the district’s board of trustees has decided to move into the big leagues of borrowing with a proposal to borrow $350 million. It’s a shame that the interest paid on that $350 million will flow from Compton (median household income: $42,953) to wealthy bond investors.

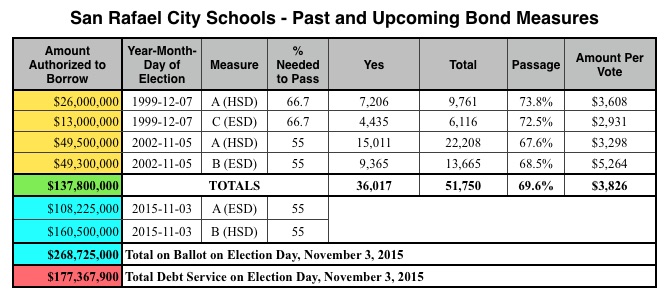

2. Who would have guessed that the number of children in Marin County was rising enough to require borrowing a total of $269 million for school construction in the elementary and high school districts in San Rafael? The San Rafael City Schools has recently borrowed $138 million and has accumulated debt service of $177 million as of today. This district must be confident that San Francisco Bay Area assessed property valuation will stay at or rise above the outrageous levels of 2015 for decades to come.

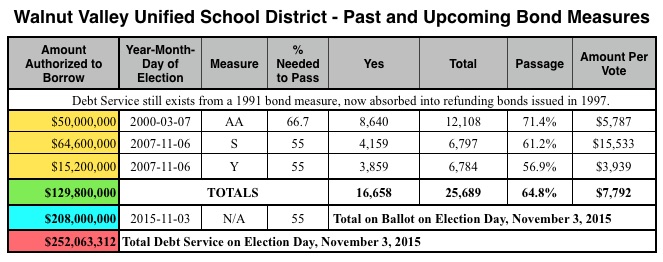

3. The Walnut Valley Unified School District in Los Angeles County sees the need to borrow $208 million for facilities construction. The $130 million borrowed by the district during the last fifteen years wasn’t enough, which is unfortunate because that borrowing has resulted today in debt service of $252 million. This district still owes money from a 1991 bond measure.

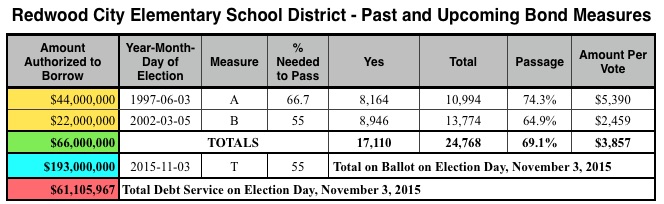

4. Like the Compton Unified School District, the Redwood City Elementary School District in San Mateo County has limited its construction ambitions in the past but now wants to move to another level. It borrowed $66 million, has debt service today of $61 million, and wants voter permission to borrow $193 million.

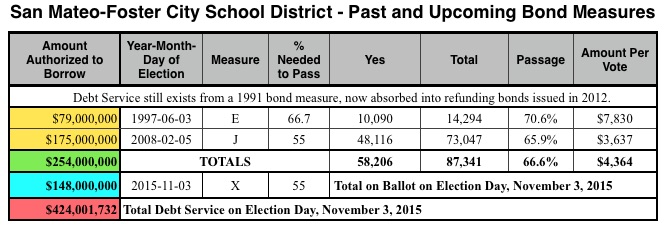

5. Voters in the San Mateo-Foster City School District in San Mateo County authorized borrowing a total of $254 million from two bond measures in 1997 and 2008. It even owes money from a 1991 bond measure. Debt service today is $424 million, but the district wants voters to approve borrowing another $148 million.

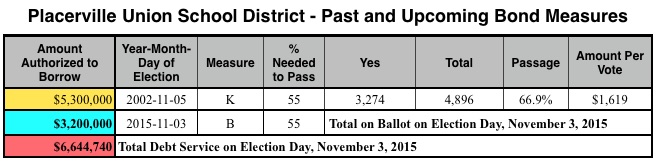

6. It’s hard to resist the allure of technology as a tool for learning. The Placerville Union School District in El Dorado County is seeking voter approval to borrow $3.2 million to focus on technology access for students. To its credit, the district board of trustees passed a resolution that prohibits selling bonds with long-term maturities and prohibits the sale of capital appreciation bonds. Nevertheless, it is still borrowing money to spend on technology, including perhaps personal portable electronic devices such as iPads and other tablet products.

There are probably several more local bond measures for educational construction on the November ballot, but the lack of an official state centralized clearinghouse of information on local bond measures makes early identification difficult. Deadlines to submit ballot arguments to county elections offices are coming fast.

For more information about these bond measures or to report additional bond measures on the ballot in your community, contact Kevin Dayton via his web site. He is the President & CEO of Labor Issues Solutions, LLC, and is the author of frequent postings about generally unreported California state and local policy issues at www.laborissuessolutions.com. Follow Kevin Dayton on Twitter at @DaytonPubPolicy.