With the March election over, the next big vote comes in November. In California, the Presidential race is unimportant — the Democrat’s nominee will win in CA in a landslide, and all the Electoral College votes will be awarded to the winner.

But the fall California election will be HUGELY important, as there will literally be HUNDREDS of new tax increases on ballots across the Golden State. One statewide levy will stand out — a multi-billion dollar annual property tax increase on our beleaguered California businesses. It will be the first phase in the progressives’ attempt to gut the REAL Prop 13 that limits the taxation of all of our real estate.

There’s much to be debated about this tax, but I’d like to start the discussion by questioning the fundamental tenet of the Democratic Party — businesses don’t pay enough taxes in our state. Of course, it’s NEVER “enough.”

Our CA property tax BILLS are actually quite high — for both businesses and homes. That’s because of the high cost of California real estate — the culmination of decades of bad state and local public policies. It’s NOT high housing demand. It’s our restricted supply, coupled with the uber-high cost of CA housing fees and regulations.

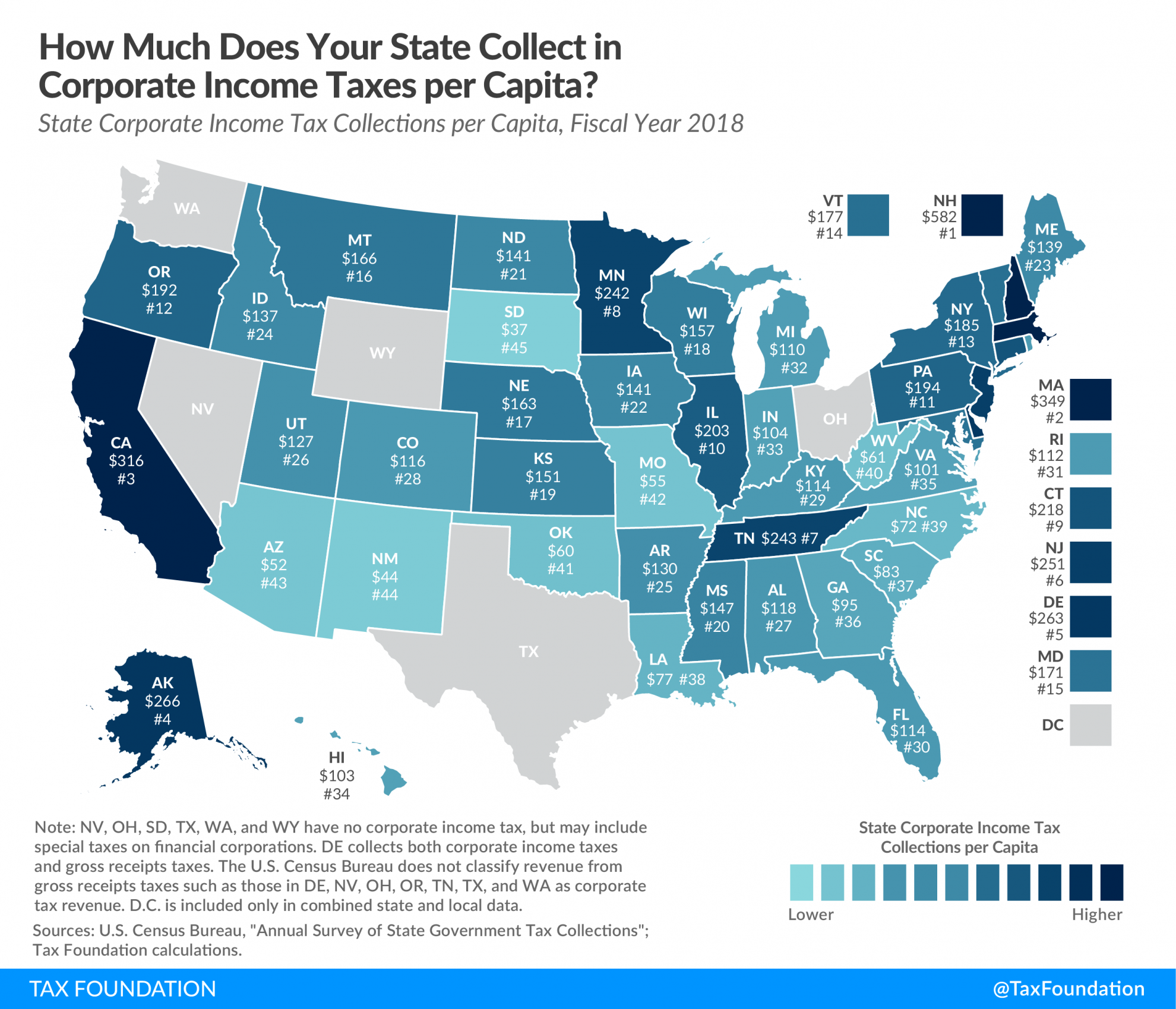

But here’s an often ignored factor — our state income taxes. Consider: CA has the top THREE state individual income tax rates in the nation. But in addition, our CORPORATE state income tax is quite burdensome as well. Indeed, per capita, California has the 3rd highest state corporate income tax in America.

The worst corporate income tax state per capita is New Hampshire, which may surprise some. But in stark contrast to California, New Hampshire has VERY little personal state income tax — just 5% on dividends and interest. No tax on earned income.

The second worst corporate income tax state is Massachusetts. But it turns out that “Taxachusetts” has a surprisingly low 5.25% state personal income tax.

Alaska is 4th right behind California AK has NO personal state income tax. Both NH and AK have small populations, so their per capita corporate tax collections are unusually high.

California has almost 40,000,000 people — yet we are ranked the third highest per capita corporate income tax state. We don’t need to hit our state’s job providers with yet another tax increase.

Six states have NO state corporate income tax. Most of the other states have far, FAR lower tax levels than California. Here’s the five lowest states (not counting thesix states with NO such tax):

The lowest corporate income collections per capita are South Dakota ($37), New Mexico ($44), Arizona ($52), Missouri ($54), and Oklahoma ($60). California collections are $316 per capita.

Here’s the full Tax Foundation article:

https://taxfoundation.org/state-corporate-income-tax-collections-per-capita-2020/?utm

How Much Does Your State Collect in Corporate Income Taxes per Capita?

Six states—Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming—do not levy a corporate income tax. However, in some states without a corporate income tax, a small amount of corporate income tax revenue is shown (such as in Ohio and South Dakota) due to taxes on specific types of businesses (such as financial institutions), which are sometimes structured as corporations.

. . .

Go to the URL to read the full article.